NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

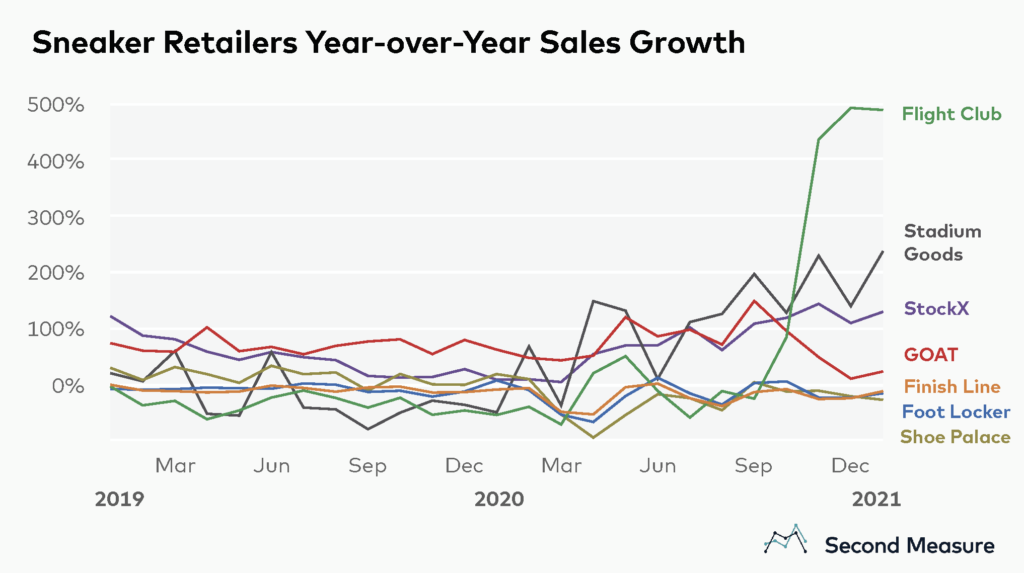

Aftermarket sneaker resellers have witnessed a surge in consumer demand over the last 12 months, likely accelerated by the closure of brick-and-mortar sneaker stores during the pandemic. While traditional sneaker retailers—FootLocker, FinishLine, and ShoePalace—saw little or no growth in 2019 and then experienced a collective year-over-year sales decrease of 72 percent in April 2020, aftermarket sneaker resellers, which largely sell online, saw a collective year-over-year sales increase of 68 percent that same month.

All four sneaker resellers sustained their growth throughout 2020, with Flight Club’s growth really taking off in November 2020. The company’s monthly year-over-year sales growth from November 2020 to January 2021 averaged at 473 percent, perhaps due in part to the company slashing seller fees in September. Bigger names like GOAT and StockX both saw annual year-over-year sales growth of 57 percent in 2019, compared to 69 percent in 2020.

By contrast, traditional sneaker retailers saw their annual year-over-year sales drop from -2 percent in 2019 to -24 percent in 2020. However, most have managed to recuperate somewhat since stores reopened after lockdown.

Ecommerce up-and-comers sneaking up on market incumbents

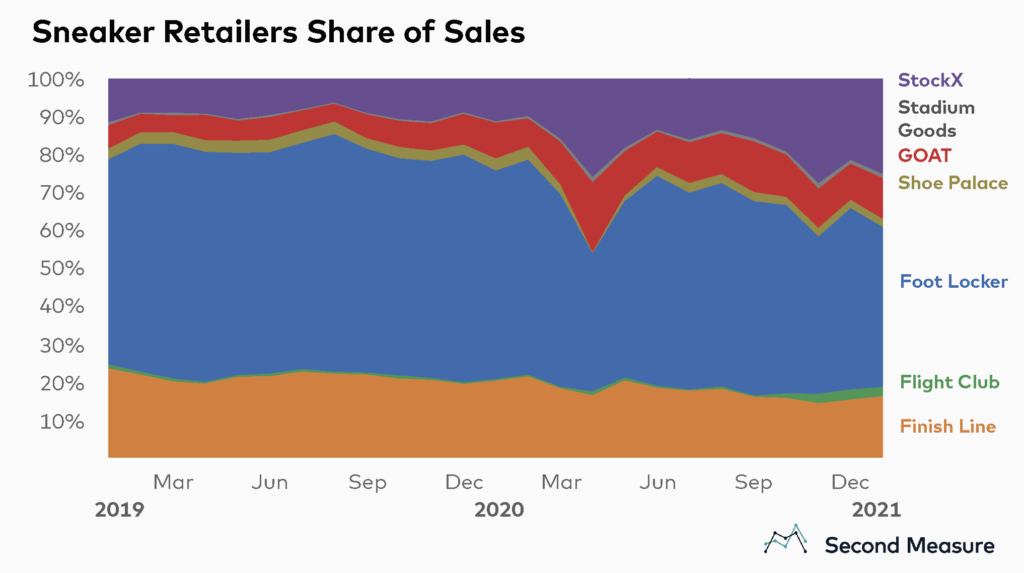

Online sneaker resellers have been eating away at traditional sneaker companies’ market share in recent years, aided by the high resale value of some sneakers, most of which list for more than twice their retail value on such sites. The chosen competitive set for the purpose of this market share analysis includes three brick-and-mortar sneakers retailers (Foot Locker, Shoe Palace, Finish Line), and the four largest after-market sneaker resellers in our dataset (GOAT, StockX, Stadium Goods, Flight Club).

Since January 2018, the larger incumbent sneaker retailers have seen a decrease in share of sales, further exacerbated by the pandemic. Foot Locker’s share of sales fell 20 percent from December 2019 to December 2020. Similarly, Finish Line observed a 21 percent decrease in share of sales within that same period.

Conversely, StockX’s share of the market has increased by 118 percent, from 9 percent in December 2019 to 19 percent in December 2020. Collectively, StockX and GOAT’s—the two largest sneaker resellers within our selected competitive set—have a combined market share of 34 percent as of January 2021.

Where are Foot Locker’s customers running to?

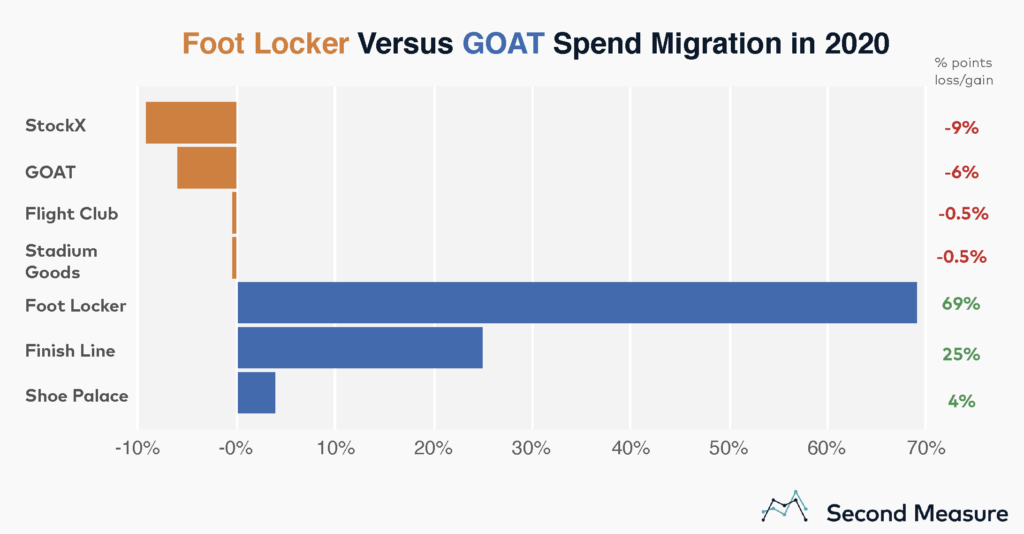

A closer look at spend migration confirms that Foot Locker, the biggest sneaker retailer in terms of sales volume, lost consumer spend to aftermarket sneaker retailers, particularly StockX and GOAT, in 2020.

Of Foot Locker’s -16 percent spend loss from 2019 to 2020, the company lost 9 percentage points to StockX, and 6 percentage points to GOAT. By contrast, GOAT’s positive spend migration from 2019 to 2020 totalled 98 percent, all of which came from the three incumbent retail companies within the competitive set. Sixty-nine percentage points came from Foot Locker, 25 percentage points came from Finish Line, and 4 percentage points from Shoe Palace.

*Note: Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.